Brazilian mango and grape exports increased in August 2025, confirming the São Francisco Valley's position as the country's main fruit production and export hub. Despite higher volumes, producers remain cautious about the international outlook, particularly in the United States, where higher tariffs introduced during the Trump administration continue to weigh on trade dynamics.

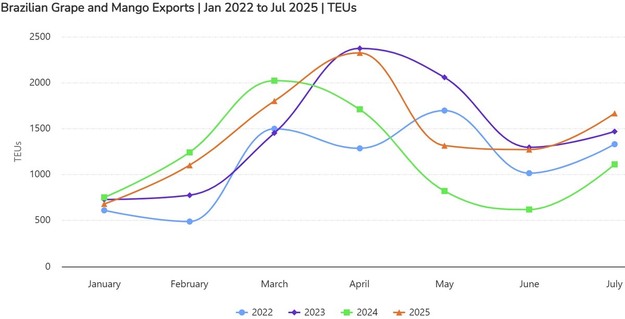

According to Comexstat (MDIC) data, Brazil exported 19,700 tons of mangoes in August, compared to a historical monthly average of 14,900 tons. From January to August, shipments totaled 131,700 tons, an increase of 18.3 per cent year-on-year. The U.S. market received 2,920 tons in August, almost double the 1,520 tons shipped in August 2024, marking a 92.4 per cent increase.

This growth follows years of uncertainty for Brazilian fruit exporters in the U.S., after tariffs on agricultural products from several countries, including Brazil, were raised to as much as 50 per cent. While competitors such as Mexico retained easier access, Brazilian mangoes faced additional costs. Despite this, exporters maintained supply to the U.S. with varieties such as Tommy Atkins, while industry associations, including Abrafrutas and Valexport, have emphasized the importance of political dialogue and market diversification. In 2025, the Netherlands accounted for 52.2 per cent of Brazil's mango exports, followed by Spain (23.27 per cent) and Portugal (7.09 per cent). Argentina (2.36 per cent) and Chile (2.11 per cent) also recorded growth.

Brazil's grape exports also advanced. In August, shipments totaled 847 tons, above the historical monthly average of 584 tons and higher than in the previous two years. From January to August, exports reached 12,400 tons, nearly double the 2024 volume. Export values rose to US$31.5 million in the period, a year-on-year increase of 73 per cent.

The Netherlands received 29.33 per cent of Brazilian grape exports, followed by Argentina (26.08 per cent), the United Kingdom (24.24 per cent), and the United States (13.49 per cent). Sea transport accounted for 69.56 per cent of shipments, with ports in Fortaleza and Salvador serving as the main export gateways for the São Francisco Valley.

With the exchange rate projected at R$5.57 per U.S. dollar by the end of 2025, exporters see potential gains in competitiveness. However, the sector remains alert to possible shifts in U.S. trade policy, which could alter access conditions for Brazilian fruit.

Source: DatamarNews