Colombia is beginning to establish itself in the global blueberry industry, shaped by rising imports, early export milestones, and new high-altitude plantations supported by international investors. The country's proximity to the United States, growing domestic demand, and nearly year-round production capacity are positioning it as an emerging competitor in key markets.

Colombia's recent export performance in avocados, lemons, and flowers, combined with logistics models from the cut flower industry, provides a framework for development in blueberries.

Domestic consumption and imports

Domestic demand is growing faster than local supply. In 2023, blueberry imports rose 29-fold to 352 metric tons, mainly from Peru and Chile. Imports in the first two months of 2024 reached 130 metric tons, already surpassing the full-year total of 2021.

Consumption has grown, with supermarkets increasingly offering premium blueberries, while open markets continue to supply lower-quality fruit. Around 95 percent of Colombian blueberry production is consumed domestically, though the processing industry is also incorporating blueberries.

© IBO

© IBO

Exports and market access

Colombia exported 99 metric tons in January 2024, a record for that month and close to the country's highest monthly shipment of 100 metric tons in December 2020. Although volumes remain small globally, they now exceed Argentina's declining exports.

Colombia's access to the U.S. depends on the implementation of a systems approach, approved in 2023 but requiring two years for full rollout. Current options include methyl bromide treatment or 14-day cold treatment. Once in place, shipping time could be reduced to seven days to Florida. Canada approved market access in 2023, with test shipments in 2024. New destinations include Thailand, Saudi Arabia, Panama, and Curaçao.

Varietal limitations

The industry faces limited access to plant material. Biloxi dominates production, followed by Emerald, Legacy, and Victoria, varieties less preferred by international retailers. Proprietary genetics remain restricted, and fewer than 30 hectares of new plantations were established in 2023. Nurseries expect rising orders in the next 12 months.

© IBO

© IBO

High-altitude production systems

Unlike Peru's coastal model, Colombian plantations are located at 2,600–3,000 meters above sea level in Boyacá and Cundinamarca. The production system resembles Mexico's non-chill model, with three peaks: November–December, May–June, and September. Most crops are open field, though protected systems under macro-tunnels are expanding.

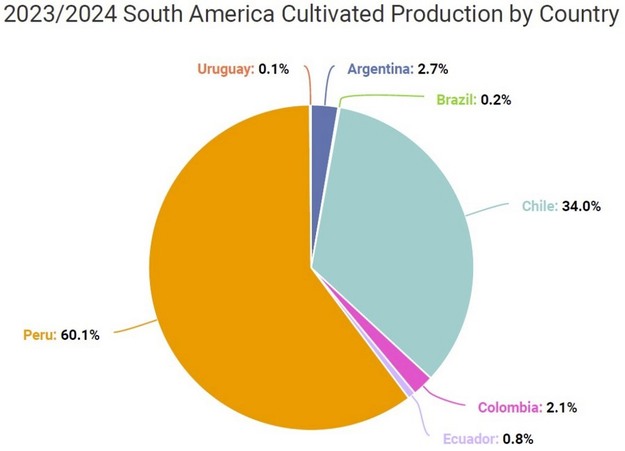

Plantings are also found in Antioquia and southern Colombia near Ecuador. Since 2016, the cultivated area has increased tenfold, surpassing Uruguay but remaining behind Argentina. Colombia has about 600 producers, though only three operate farms over 20 hectares.

New projects are planned, including a joint venture with Australian genetics aiming for 50 hectares in two to three years, and other initiatives backed by U.S. and Chilean investors. Expansion in area and varietal quality is expected to strengthen Colombia's position in the United States, Europe, and Asia.

Source: Blueberries Consulting