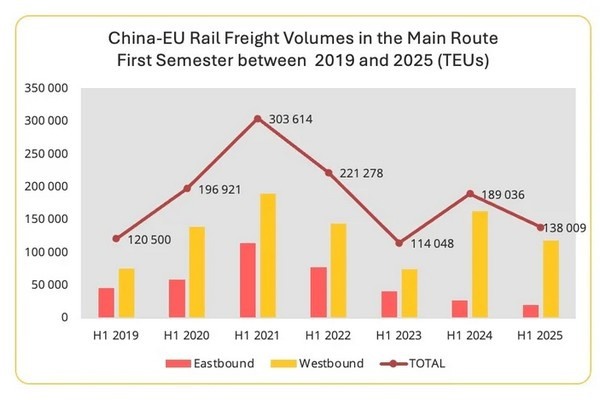

China-EU rail freight volumes declined in the first half of 2025 despite an increase in overall East-West trade. Rail freight has not secured a structural position in trade flows between China and the European Union. Since 2019, spikes in activity have mainly been linked to external disruptions such as the post-COVID recovery in 2021 and maritime transport disruption in the Red Sea in 2024. Once maritime transport stabilised, shippers tended to return to previous logistics models.

© ERAI

© ERAI

In the first half of 2025, overall traffic was 138,009 TEUs, a 27% decrease compared to the same period in 2024. Westbound rail traffic fell by 27.4% to 118,291 TEUs, while eastbound volumes dropped by 24.7% to 19,718 TEUs. Traffic remains asymmetrical, with Chinese exports representing 86% of the total. Since 2019, average growth for the first six months of each year has been limited to 2.3%, with a 14% decline in the West-East direction and a 7.9% increase East-West. Flows to the Chinese market have continued to erode since 2021.

The imbalance in flows reflects the EU's widening trade deficit with China. Chinese imports from the EU fell by 5.9% in the first half of 2025, while exports to the EU grew by 6.6%. On average, since 2019, exports have risen by 4.72% annually, while imports have fallen by 1.34%. Rail freight has not capitalised on this export growth. Shippers who had switched to rail during Red Sea disruptions in 2024 have largely returned to maritime transport, which remains slower but stable and competitively priced via the Cape of Good Hope.

© Chinese Customs

© Chinese Customs

Poland continues to consolidate its role as the main European entry point for eastbound freight. The China-Poland corridor represented 93.4% of eastbound volumes in the first half of 2025, compared to 82.5% in the same period in 2024. While erosion was less severe than on other routes, traffic between China and Germany was reduced threefold, and flows between China and Belgium declined tenfold. Flows to Hungary collapsed from 2,570 TEUs to negligible levels.

In the opposite direction, Germany-China remained the main westbound corridor with 13,978 TEUs, or 71% of total flows, but volumes declined by 26% year-on-year. Poland-China volumes fell 16.6% to 4,886 TEUs. Both declines were linked to reduced shipments from the automotive sector.

Source: Upply