In Marketing Year (MY) 2025/26, walnut production in Chile is projected to reach 150,500 metric tons (MT), a 1.3 per cent decrease compared to 152,500 MT in MY 2024/25. The reduction is attributed to a smaller planted area of 43,500 hectares, down 1.1 per cent year on year, along with regular yields following favorable climatic conditions. The decline in area reflects market conditions and competition from more profitable crops such as cherries, lemons, and mandarins, as well as urban expansion.

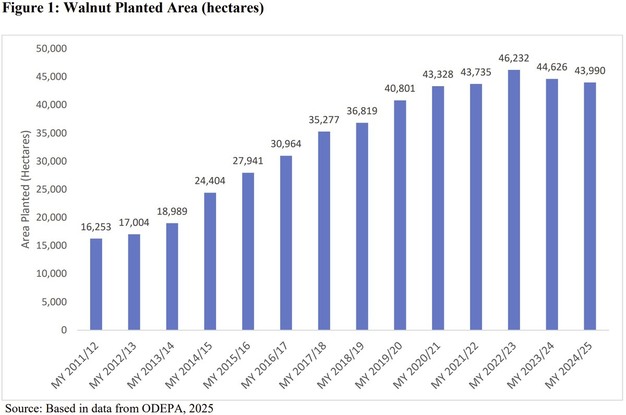

In MY 2024/25, the total walnut planted area was 43,990 hectares, representing a 4.8 per cent decrease over the past three years. Most production is concentrated in the Metropolitana, O'Higgins, and Maule regions, which together account for 73.3 per cent of the total area. The Metropolitana region, Chile's top walnut-producing area with 15,522 hectares, recorded a 5.5 per cent reduction over the past three years as orchards were replaced by other crops or displaced by urban growth. Area planted in Valparaíso and Coquimbo also decreased, by 9.9 per cent and 43.3 per cent, respectively, as walnuts were replaced mainly by lemons, mandarins, and cherries.

Almond production is forecast at 11,450 MT in MY 2025/26, reflecting a 0.9 per cent decline from MY 2024/25.

Domestic walnut consumption is projected to rise slightly to 2,900 MT, up 1.8 per cent year on year, supported by population growth and steady demand. Shelled walnuts are mainly consumed as snacks, while fragmented walnuts are used in confectionery products. Domestic almond consumption is forecast to remain stable at 7,700 MT, while imports of almonds, primarily from Chile, are projected to hold steady at 4,000 MT. Walnut stocks are expected to remain unchanged at 3,950 MT, and almond stocks are projected to increase by 18.3 per cent to 969 MT.

Walnut exports are forecast at 148,000 MT in MY 2025/26, a 1.3 per cent decrease reflecting the smaller crop, although global demand remains steady. Chile continues efforts to reduce the 100 per cent tariff imposed by India, one of its main markets, to expand export opportunities. Limited global supply is keeping prices firm, supporting Chile's competitiveness in international markets. Key destinations, including India, Turkey, Italy, and Germany, are expected to remain important outlets.

In MY 2024/25, exports peaked in May and June, consistent with regular seasonal patterns. Export volumes declined in July compared to the previous year, despite strong yields earlier in the season.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 202 720 2791

Email: [email protected]

www.apps.fas.usda.gov