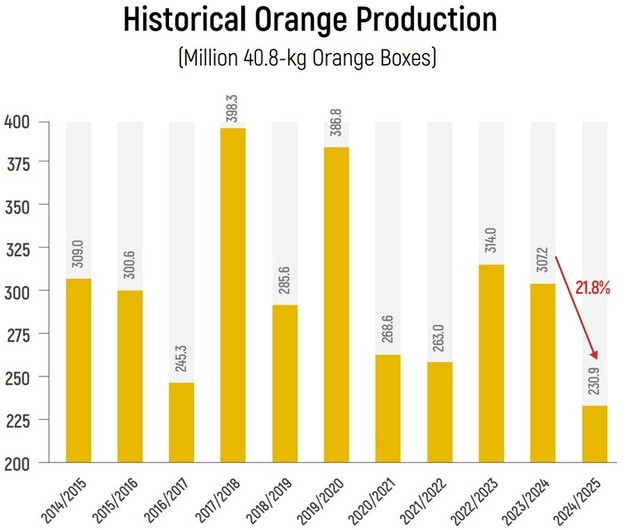

According to Fundecitrus data published in April 2025, the 2024/25 orange crop in the São Paulo and Minas Gerais citrus belt closed at 230.9 million 40.8-kg boxes. This was the smallest crop in more than 30 years, reflecting five consecutive low-yield seasons caused by prolonged drought and severe weather. The volume was 21.8% lower than the 307.2 million boxes harvested in 2023/24.

© Brazilian Association of Citrus Exporters (CitrusBR)

© Brazilian Association of Citrus Exporters (CitrusBR)

Orange processing

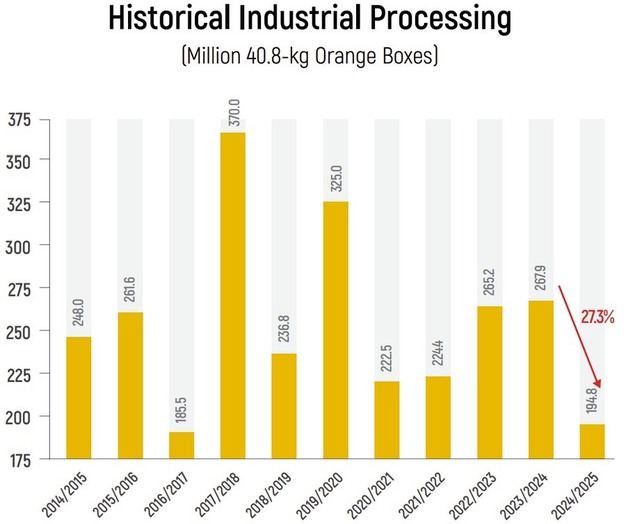

Figures from CitrusBR member companies, consolidated by an external auditor, indicate that 194.8 million boxes of 40.8 kg were processed in 2024/25. Of this total, 171.0 million boxes were processed by CitrusBR members and 23.7 million boxes by non-members, including fruit from own groves and third-party suppliers. This represented a 27.3% decline compared with the 267.9 million boxes processed in 2023/24.

© Brazilian Association of Citrus Exporters (CitrusBR)

© Brazilian Association of Citrus Exporters (CitrusBR)

Industrial yield

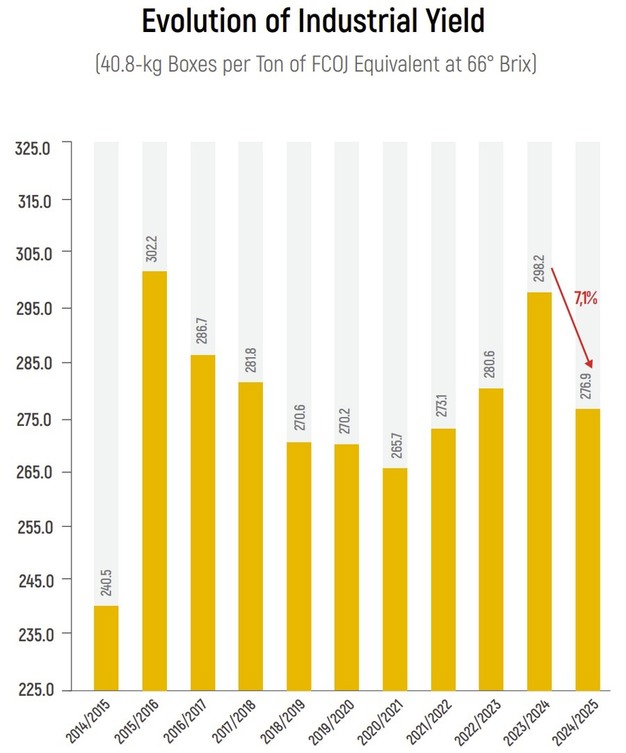

The industrial yield in 2024/25 was estimated at 275.7 boxes per metric ton of FCOJ equivalent at 66° Brix for CitrusBR members, and 286.7 boxes per metric ton for non-members. The weighted average stood at 276.9 boxes per metric ton of FCOJ equivalent at 66° Brix. This was a 7.1% improvement compared with the 298.2 boxes per metric ton reported in 2023/24.

© Brazilian Association of Citrus Exporters (CitrusBR)

© Brazilian Association of Citrus Exporters (CitrusBR)

Orange juice production

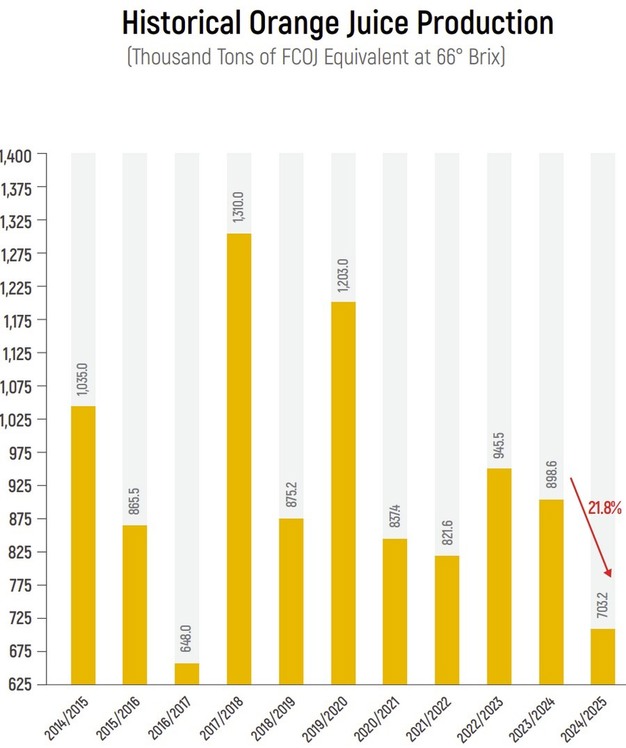

Total orange juice production in 2024/25 was estimated at 703,200 metric tons of FCOJ equivalent at 66° Brix. This was 21.8% lower than the 898,700 metric tons produced in 2023/24.

© Brazilian Association of Citrus Exporters (CitrusBR)

© Brazilian Association of Citrus Exporters (CitrusBR)

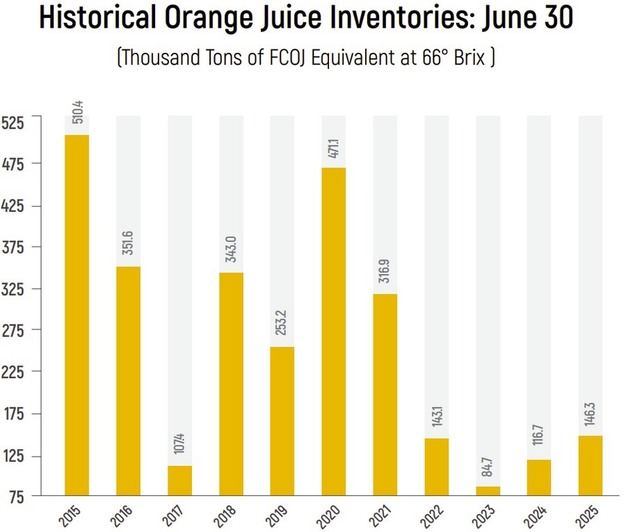

Juice inventories

An independent audit of CitrusBR member companies, consolidated by an external auditor, reported that global inventories of Brazilian orange juice held by members reached 146,300 metric tons of FCOJ equivalent at 66° Brix on June 30, 2025. This represented a 25.4% increase compared with 116,700 metric tons on June 30, 2024. Despite this increase, inventories remain among the lowest in historical records, reinforcing the global supply constraint scenario.

© Brazilian Association of Citrus Exporters (CitrusBR)

© Brazilian Association of Citrus Exporters (CitrusBR)

For more information:

Brazilian Association of Citrus Exporters

Tel: +55 11 2769 1205

Email: [email protected]

www.citrusbr.com