In August 2025, the South African government stated it would "do everything possible to keep the American market open for our goods." Officials also noted that alternative steps were being taken, including diversifying trade partners and stimulating local demand.

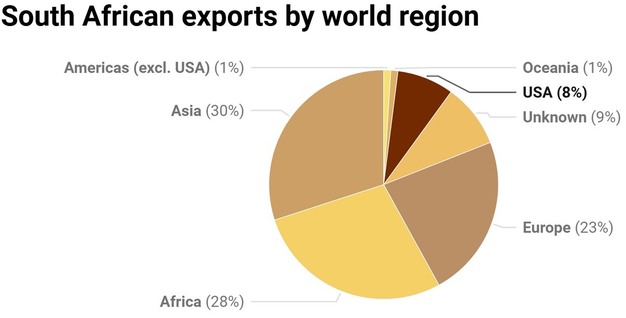

At a Japanese forum on African development, President Cyril Ramaphosa said the tariffs imposed by the United States were a setback but also an opportunity to find "new markets" in Asia, the Middle East, India, and Europe. Trade officials stressed that diversification was "not a plan B [but] a plan A for long-term resilience and competitiveness." According to the South African Reserve Bank, exports between 2001 and 2019 shifted from the U.S. and Europe toward China and Africa, although this reversed after 2013.

In 2024, the U.S. accounted for 7.45% of South Africa's exports, valued at about US$8.5 billion, making it the third-largest export market after China and Germany. By comparison, South Africa supplied only 0.25% of U.S. imports. Economist Dr Sean Muller said diversification requires sector-level analysis. He pointed to citrus as an example, where producers need to identify alternative demand and adapt products to fit those markets. Dr Marvellous Ngundu of the Institute for Security Studies noted that China's demand for macadamia nuts could offer opportunities, but losses in the U.S. market would still reduce revenue.

© South African Parliamentary Budget Office

© South African Parliamentary Budget Office

South Africa is also pursuing regional integration through the African Continental Free Trade Area (AfCFTA). By June 2025, 49 African Union states, including South Africa, had formally agreed to the agreement. Ramaphosa described the AfCFTA as "central to our economic vision" and said work was ongoing to finalise value-chain protocols in automotive, agro-processing, pharmaceuticals, and textiles. The World Bank projects that full AfCFTA implementation could raise Africa's income by 7% by 2035, while the ISS estimates South Africa's economy could be 11.6% larger by 2043, with exports up by US$85.2 billion.

South Africa remains dependent on commodities, which make up more than 60% of exports. In 2022, raw materials and intermediate goods accounted for 70% of exports, while manufactured consumer and capital goods represented 28%. Economists highlighted beneficiation, or adding value to raw materials, as one way to reduce reliance on commodity exports, but structural challenges such as skills shortages remain.

Officials have also raised localisation, encouraging more domestic production to replace imports. Experts warned that localisation could conflict with World Trade Organization rules or undermine the AfCFTA if implemented as a barrier to imports.

Finally, the government aims to boost domestic demand through initiatives like Proudly South African. However, analysts cautioned that South Africa's domestic market is limited. Prof Lawrence Edwards of the University of Cape Town said, "We're just a small country, so if we just focus on selling to our domestic market, we are forgetting 99% of the world as a global market we can sell to."

Source: Polity