On 29 August 2025, UK exporters will lose access to the U.S. de minimis threshold of US$800. The exemption has allowed UK SMEs to export directly to U.S. consumers without duties or complex paperwork. Its removal has already led to postal services across Europe suspending deliveries to the U.S. until customs authorities provide clarification.

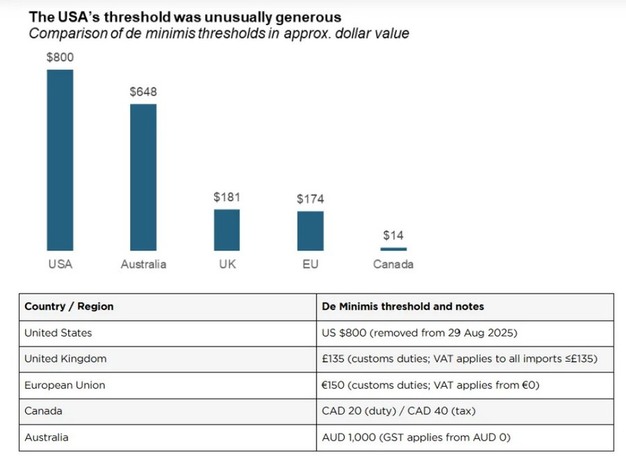

The de minimis threshold was introduced in 2016. It enabled shipments under US$800 to enter the U.S. duty-free. In 2021, goods worth around US$5 billion were shipped from the UK to the U.S. under this exemption, with around 80% of shipments moving through e-commerce channels. Clothing and fashion products accounted for a large share, with most parcels being single, low-value items purchased online by U.S. consumers. Compared to other countries, the U.S. threshold was far higher, while others maintain more modest limits.

© British Chambers of Commerce (BCC)

© British Chambers of Commerce (BCC)

The U.S. administration cited concerns about fraud, competition from foreign sellers, and support for domestic manufacturing as reasons for the policy shift. Research from the OECD and other institutions has indicated that de minimis thresholds reduce fixed trade costs and compliance barriers, disproportionately benefiting SMEs.

The policy change comes as UK SME exporter sentiment is already low. In Q2 2025, 22% of exporters reported increased orders, while 27% saw declines. Smaller exporters were the most affected. Brexit has been noted as a parallel, where new trade barriers after the Trade and Cooperation Agreement in 2021 led to backlogs and higher costs. By 2022, 15% of surveyed exporters said they had increased their presence in the EU as a direct response. Analysts suggest a similar adjustment process may now follow in relation to U.S. trade.

Postal suspensions mark the first visible impact, but firms accustomed to duty-free exports will face permanently higher costs. Some may reduce exports, while others may establish a U.S. base to continue trade.

© British Chambers of Commerce (BCC)

© British Chambers of Commerce (BCC)

The end of the U.S. de minimis threshold is part of a wider global shift. The EU is considering removing its €150 exemption, centralising customs oversight, and adding a €2 fee per item to cover compliance. The UK may review its £135 threshold, with HM Treasury estimating up to £1 billion in additional customs duties.

For SMEs, this will increase pressure on costs and operations. Exporters will need to coordinate with distributors, logistics providers, and online partners, and ensure proof of origin for tariff purposes. In the longer term, their ability to compete will depend on a UK trade strategy that prioritises stronger supply chains, targeted business support, and modernised digital trade infrastructure.

For more information:

British Chambers of Commerce (BCC)

Tel: +44 (0) 1224 343900

Email: [email protected]

www.agcc.co.uk