Forecasts for the Polish apple crop indicate stable to higher yields, with some market participants expecting a bumper harvest.

Poland experienced frost in April and May, with overnight temperatures falling between −3°C and −7°C in certain regions. Hailstorms in June further affected early fruit development. However, August brought rainfall and weather more favorable for growth, improving expectations for volumes as the harvest season begins.

The August forecast from the World Apple and Pear Association (WAPA) projects Polish apple production in 2025 at 3.3 million metric tons (mt), representing a 3.4% increase year-on-year but 15.5% below the three-year average. The Polish Statistical Office, in data released in July, estimates 3.6 million mt, while some industry participants expect volumes closer to or even exceeding 4 million mt. If this materializes, it would be the highest level since 2022 and a rebound from the 3.2 million mt reported in 2024 by WAPA.

In contrast, other major producers are forecasting declines. Turkey and China also faced adverse conditions earlier this year. Turkey is expected to see the largest drop, with output projected to be 40% lower year-on-year, according to WAPA and market sources. Lower volumes in both countries are expected to impact the apple juice sector, where processors may face difficulty sourcing raw material.

In Poland, despite strong output expectations, there are uncertainties for processors. Industry reports cite labor shortages for picking, a recent shift to dry weather, and the likelihood of reduced supply to processing, as the fresh market is often prioritized.

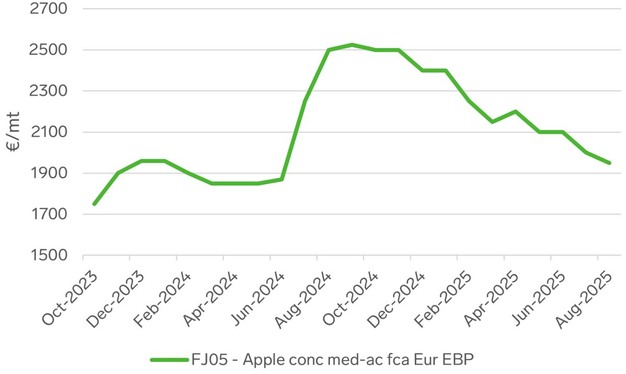

Expana Benchmark Prices (EBP) for apple concentrate medium acid FCA Europe stood at €1,950/mt (US$2,082/mt) in August, down 2.5% month-on-month, as the market factored in expectations of higher Polish production.

Source: Mintec/Expana