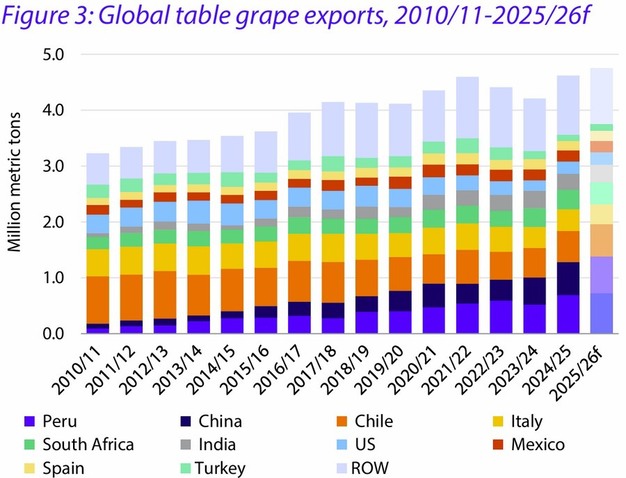

Peru has surpassed Chile to become the world's leading exporter of table grapes, while China is emerging as a major competitor, according to a recent RaboResearch report. Global exports reached 4.6 million metric tons in 2024/25, the highest on record, with projections suggesting further changes in trade flows by the end of the decade.

© Rabo Research

© Rabo Research

Peru and China shift global dynamics

Peru's position at the top of the export market reflects broader shifts in competitiveness within the sector. At the same time, China is expanding its role as both a producer and exporter, with volumes projected to exceed 100 million boxes. Rising demand in Southeast Asia is playing a central role, while China's increasing self-sufficiency has reduced its reliance on imports.

North America: United States and Mexico

In North America, U.S. table grape exports are stabilizing, supported by increased demand in Mexico. Growth in Mexico is linked to retail expansion and steady consumer demand. Despite earlier weather-related disruptions, South American exports rebounded in 2024/25 to reach 1.3 million metric tons, setting a higher baseline for the current season.

© Rabo Research

© Rabo Research

European Union and U.S. imports

The European Union and the United States remain the largest importers of table grapes, together accounting for 43% of global imports. Over the past decade, both markets have recorded average annual import growth of around 2%. In the U.S., per capita consumption has risen to 8.2 pounds per year on average over the past decade, with forecasts indicating a potential increase to 9 pounds in 2025/26.

© Rabo Research

© Rabo Research

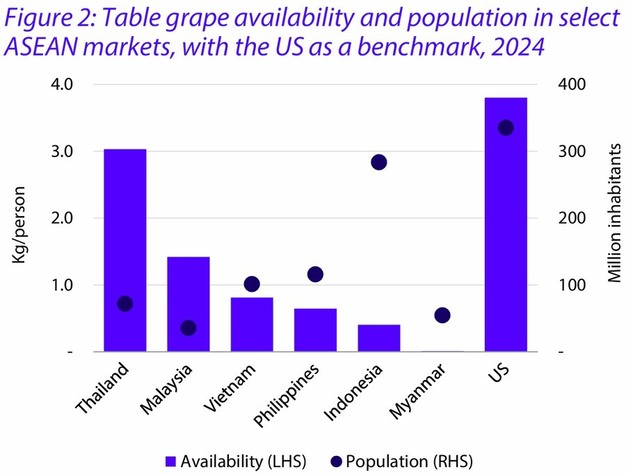

Southeast Asia as a diversification option

Southeast Asia is becoming a key destination for exporters as China reduces its import demand. Rising consumption in the region offers opportunities for diversification and new trade routes for global suppliers.

For more information:

Gonzalo Salinas

Rabobank

Tel: +56 2 2449 8000

Email: [email protected]

www.rabobank.com