The termination of the tomato suspension agreement has created a rollercoaster for the Mexican tomato industry. U.S. fresh produce importer SunFed doubts the outcome, warning: "One way or another, prices will go up, and consumers will bear the cost as retailers won't cut into their own margins." The company questions whether the alleged unfair trading practices justify ending the agreement. "I admit Florida has a disadvantage, but are these truly unfair trading practices? When you look below the surface, there's a lot more to it."

Background of the agreement

The tomato suspension agreement was first introduced in 1996, following allegations that Mexican tomatoes were being sold below the cost of production. In response, U.S. authorities launched an investigation and imposed a 17 percent anti-dumping duty on the industry. The agreement suspended the application of these duties, provided that the established rules and conditions were upheld.

The suspension agreement has been renegotiated every five years and revised multiple times. "The most widely known provision—the minimum floor price—has been adjusted with each renewal," explains Matt Mandel, Executive Vice President at SunFed. Based in southern Arizona, the fresh produce company has operated in Mexico for decades. Mandel notes that with every renegotiation, new hurdles were introduced for both Mexican exporters and U.S. importers. "Honestly, we had to change entire business practices to ensure we were in compliance with the agreement."

There is also a long and complex history behind these negotiations. According to the industry body Florida Tomato Exchange, there was widespread circumvention of the agreement. "However, when asked for evidence, none was ever provided. The only publicly cited statistic was that Florida growers accounted for 80 percent of U.S. tomato sales when the agreement was first implemented," says Mandel. As of the most recent agreement, that market share had dropped to 20 percent. "They claim this decline is the result of unfair trading practices, but when you look below the surface, there is a lot more to it."

Shift to CEA

Mandel explains that the Mexican tomato industry has developed, with most export tomatoes nowadays being grown in shade houses or greenhouses. "Less fertilizer and water are needed, there are fewer pests, and yields per acre are up dramatically, all while producing a far superior, better tasting, more consistent tomato. These production methods open the door for varieties that can't be grown in the open field." Varieties include vine-ripened tomatoes, snacking tomatoes, and tomatoes on the vine, which have grown to be highly popular among American consumers.

In addition to Mexico, the development of Controlled Environment Agriculture (CEA) can also be witnessed in the U.S., but not in Florida. "High humidity, pest pressure, and the risk of hurricanes prevent the greenhouse industry from developing in Florida," Mandel explains. "Combined with the local climate, many popular tomato types can't be grown or don't grow well in Florida. Customers have voted with their dollars, and as a result, the number of Florida tomato farms has decreased over the years. Farms consolidated, and other growers decided to sell their land for real estate development. At the same time, Mexican production increased thanks to the shift to CEA. As a result, Florida nowadays represents only a small portion of the tomato industry."

"I admit Florida has a disadvantage, but are these unfair trading practices?" Mandel wonders. "I am all for fair trade in the marketplace, but until some evidence can be shown that fair trade is not happening, I refuse to believe that this is a valid excuse for the termination of the agreement."

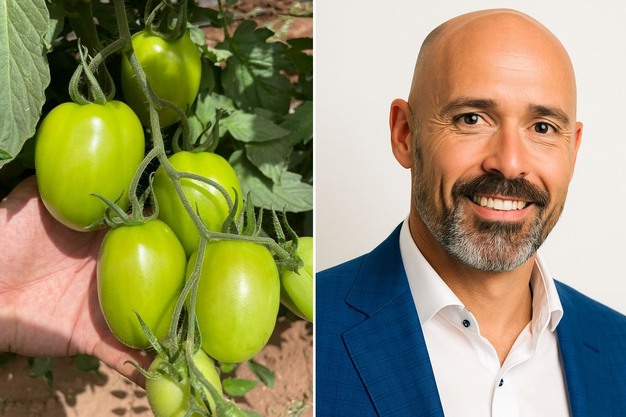

© Sunfed

© Sunfed

Right: Matt Mandel.

Minimum price from Mexico

Following the termination of the suspension agreement, the 17 percent duty was reinstated. Similarly, in an attempt to prevent future allegations of dumping, the Mexican government has set a minimum export price.

"Some of the prices Mexico initially suggested were wild and implied an 80 percent price increase over the prices listed in the suspension agreement," Mandel says. Based on feedback, the pricing was re-evaluated and updated in line with production costs and international reference prices for certain types of fresh tomatoes. The adjusted prices are meant to support the participation of the Mexican tomato export industry in international markets at competitive prices. The new minimum export prices went into effect on September 8th.

Personally, Mandel believes the mandatory floor price from the suspension agreement worked out very well for all interested parties. "Although domestic growers were still able to undercut the prices and did so regularly, it still raised the market for both domestically grown and imported tomatoes. However, I do have my concerns as to how the new minimum price will be implemented and what the repercussions will be on the import community."

Impact on tomato trade

Under the Change of Circumstance review, there is an inquest to determine whether the 17 percent duty still makes sense. "At this point, it is unknown if and when the review will actually take place. There is still a large vocal majority in the United States in the tomato trade that is petitioning the Department of Commerce to go back to the negotiating table and come up with a new system," Mandel says. "The termination created a temporary new normal, but it is unknown how long it will last."

It's exactly this uncertainty that has the biggest impact right now. "It is too early to tell what the long-term impact on tomato prices will be. Because of the long time between planting and harvesting the first box, there's trepidation as to whether the original plans are being continued." As a result, growers, if they weren't already, are looking at diversifying: other Mexican greenhouse vegetables are not affected by the termination of the agreement and fall under USMCA, meaning there are no tariffs for the moment.

"If growers were already diversified, they may reduce their plantings and switch to other commodities. For some, this switch would imply an investment in changing the infrastructure, which would further complicate things and create ripple effects on other commodities. Entirely hypothetical, but what happens if 50 percent of the tomatoes go to cucumbers, as unlikely as that is? It could cause flooding in the market, and would that result in an anti-dumping case? It may result in inquiries about the sales and pricing of other commodities. All involved, from the producers to the importers, will be actively working to prevent a situation like that from coming to pass."

"If farmers diversify and there is less supply coming in, simple supply and demand says that prices will go up. If domestic farmers see less supply and a higher demand, they are absolutely going to raise their prices. So, one way or another, prices will go up. These increased prices will be passed on to consumers as retailers aren't going to cut into their own margins."

In general, demand for tomatoes has been down lately, which likely has to do with the general economic insecurity in the U.S. as the average consumer is financially struggling. "That financial insecurity, combined with increased costs, will very unlikely result in a further decrease in demand. Over the last five years, inflation has been high, and prices have gone up faster in comparison to income," Mandel comments.

Programs continue as usual

SunFed itself is not seasonally in the tomato trade at the moment and won't get started again until mid to late October. "I feel we're in a good place and sit on the sidelines, seeing how it all shakes out," Mandel admits. While it is a slower time of year, there's still quite some volume of tomatoes imported on a daily basis and trade hasn't stopped one bit. "One reason trade continues is the fact that growers planned their acreage six months in advance. All tomatoes that were already in the ground before the Department of Commerce posted their notice to terminate the agreement are being harvested right now."

SunFed is now having conversations with its retail partners about the company's tomato programs for fall and winter. This coming fall, the company is planning to commence with the same tomato programs it had in the past. "We have a built-in customer demand that we'll try to meet, but conversations regarding pricing are getting a little more interesting, and we will have to continue having these conversations up until the first tomatoes are being shipped. When setting up contracts, clauses need to be put in for any government intervention that is going to significantly change the tomato trade. These stipulations are necessary in covering those inevitabilities."

"We hope the American consumer will be able to continue spending their disposable income on fresh fruits and vegetables and hope the situation changes for them. Produce is the healthiest food in the supermarket, and we would love consumers to spend their money on produce."

© Sunfed

© Sunfed

Hard to take efforts and accusations

"It is all very uncertain, but because most people in this business do what they love, they keep going," Mandel concludes, although he says it affects him. "The growth in Mexico's tomato industry has been driven by U.S. companies that see an opportunity in the marketplace and are trying to meet customer demand. These undermining efforts and accusations of unfair trading practices are hard to take."

Ultimately, he is convinced the suspension agreement helped drive diversity in the tomato market because non-tariff barriers were placed in every single agreement. "These included mandatory USDA inspections on every load coming in, which pushed foreign growers to get better. At the same time, the domestic industry wasn't held to these standards. Because of that, some have fallen behind, frankly."

"As an American citizen, the last thing I want is for U.S. farming to go away, but I think of imports as a complement to what's being grown domestically," he continues. "The marketplace is competitive, and if a company is unable to compete, I don't think it's the government's job to help them find profitability by forcing down competition. In the end, that will only drive prices up. Suppressing competition will result in everybody taking a loss in the end."

Mandel closes by saying that every season comes with its own unique set of risks, and every season is different. "We just have to remain nimble and positive. We will take the punches on the chin and keep going."

For more information:

For more information:

Matt Mandel

SunFed

Tel: (+1) 520-761-6813

[email protected]

www.sunfed.net