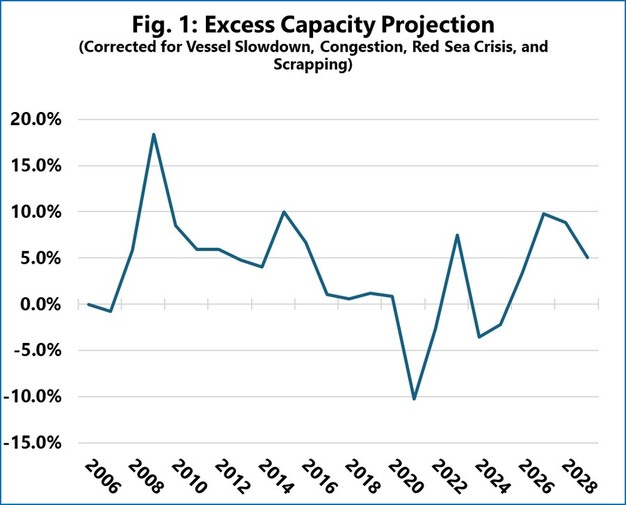

A recent analysis of the global container shipping industry suggests that the market is structurally moving toward a new phase of cyclical overcapacity, expected to peak in 2027 at levels last seen during the 2016 container shipping price wars.

The projection is based on nominal vessel supply compared with expected container demand growth, adjusted for several operational factors. These include the long-term structural slowdown of vessels, the impact of port congestion, capacity absorption linked to the Red Sea crisis, and an anticipated increase in vessel scrapping. The demand outlook is tied to global GDP growth.

© Sea-Intelligence

© Sea-Intelligence

According to the corrected model, the market is expected to transition from the recent period of capacity shortages into pronounced overcapacity. This oversupply is projected to peak in 2027, though not to the same extent as during the 2009 financial crisis. The forecast assumes that the Red Sea crisis will be resolved by mid-2026, which would return a substantial amount of capacity to the market.

The outlook remains uncertain. The projection relies on the expectation of a notable rise in vessel scrapping from 2026 onwards, removing part of the fleet that is more than 20 years old. The timeline of any resolution to the Red Sea crisis is a critical factor: a prolonged disruption would continue to absorb capacity, while a quicker resolution would add to oversupply.

Other risks include the potential impact of the ongoing US trade conflict on container demand and the possibility of further new vessel orders, which could add to future capacity pressures.

For more information:

Sea-Intelligence

Email: [email protected]/ [email protected]/ [email protected]