India remains a major importer of almonds, walnuts, and pistachios due to strong domestic demand and limited local production. While almonds and walnuts are produced domestically, pistachios are not grown on a commercial scale. Imports of all three nuts are projected to rise in marketing year (MY) 2025/2026 (August–July), with estimates of 190,000 metric tons (mt) of almonds, 75,000 mt of walnuts, and 55,000 mt of pistachios.

Production

Almond production in MY 2025/2026 is forecast at 4,100 mt (shelled basis), reflecting climate disruptions and poor soil moisture in Jammu and Kashmir and Himachal Pradesh, the main producing states. Farmers face challenges, including adverse weather, aging orchards, and the absence of a centralized almond market, which forces sales through external channels. Some growers are shifting to apple cultivation, which is supported by government schemes.

According to the National Horticulture Board, Jammu and Kashmir accounts for more than 91 per cent of India's almond output, followed by Himachal Pradesh (8.7 per cent) and Maharashtra (0.09 per cent). Varieties include Shalimar, Makdoon, Waris, and Kagazi, with shelling rates ranging from 20–30 per cent for hard-shelled types and up to 40 per cent for thin-shelled types. Government initiatives to revive the sector include high-density plantations, new nurseries, and improved irrigation, though competition from apples persists.

Consumption

Almond consumption in MY 2025/2026 is projected at 195,840 mt, supported by rising incomes, urban demand, and health awareness among younger consumers. Half of India's population is under 30, and almonds are increasingly used in sweets, cereals, granola bars, snacks, chocolates, cookies, and ice cream. Imports of almond milk, flour, and butter are also increasing, driven by the food processing and personal care industries.

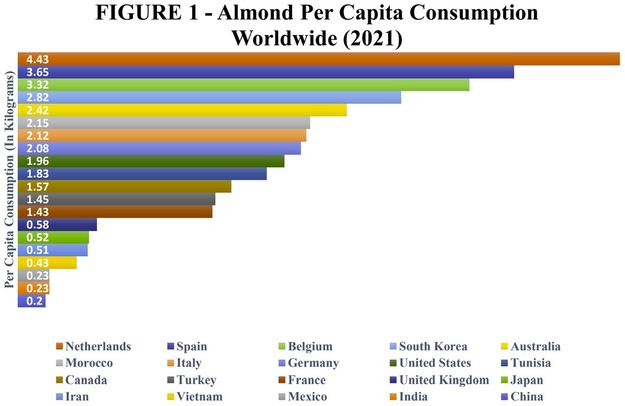

India ranks second globally in almond consumption after the United States. Per capita consumption remains low at 0.23 kilograms compared to over 1 kilogram in other markets, suggesting scope for further growth. India's healthy snacks market, valued at US$3.91 billion in 2024, is forecast to reach US$6.12 billion by 2030.

Trade and stocks

Ending stocks in MY 2024/2025 are estimated at 32,000 mt, as lower prices in MY 2023/2024 encouraged importers to increase inventories. Imports in MY 2025/2026 are forecast at 190,000 mt, up 6 per cent from the USDA official estimate of 180,000 mt for MY 2024/2025.

Following the removal of retaliatory tariffs in September 2023, U.S. almond exports to India grew sharply, with values between January and May 2025 up 50 per cent year-on-year. California almonds account for about 85 per cent of the Indian market, followed by Australian almonds at 10 per cent. Most U.S. and Australian imports are in-shell varieties such as Nonpareil and Carmel, which are shelled locally. This adds value through processing and supports local employment under the "Make in India" initiative.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.apps.fas.usda.gov