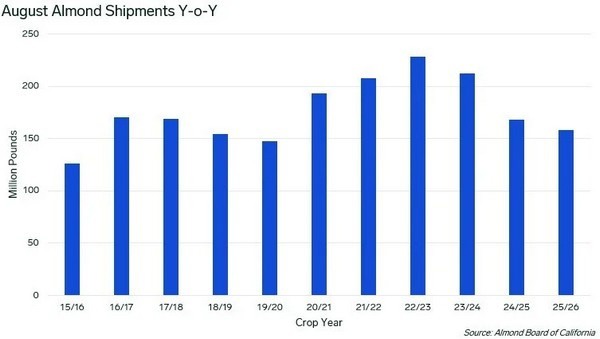

On September 11, the Almond Board of California (ABC) released the August position report, providing the first view of the 2025/26 crop year. U.S. almond shipments totaled 158 million pounds (71,668 tons) in August 2025, down 6% from August 2024 and marking the slowest start to the season since 2019.

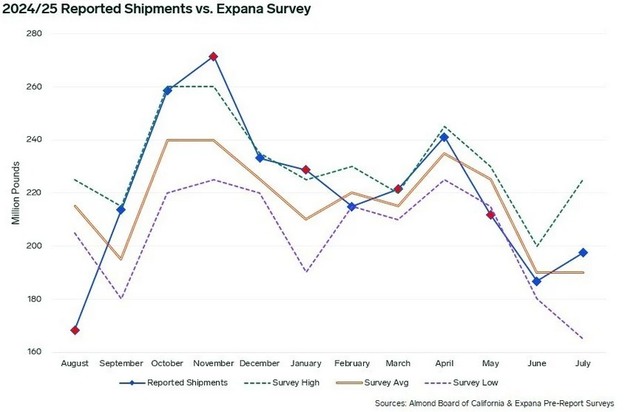

Market expectations ahead of the report, based on an Expana survey, averaged 195 million pounds with a range of 175–230 million pounds. Similar to the 2024/25 season, shipments began below estimates. Throughout last season, reported shipments were within the survey range for seven of twelve months, with only two months well outside expectations.

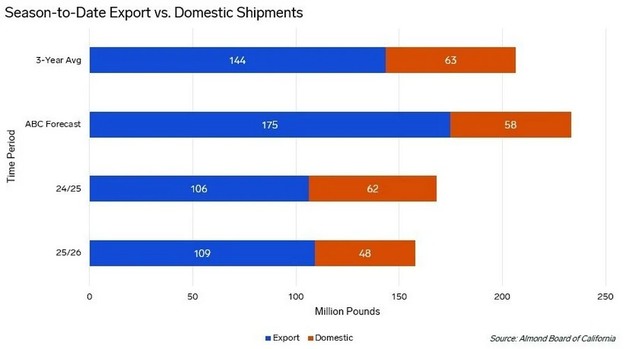

Of the 158 million pounds shipped, 48 million pounds were domestic (-22% year-on-year) and 109 million pounds were exported (+3% year-on-year). While ABC forecasts that 75% of the crop will be exported in 2025/26, the three-year average stands near 73%, with early shipments typically weighted toward international markets.

Regional flows showed mixed trends. Shipments to India fell to 16.4 million pounds (-41% year-on-year), while Europe rose to 43.4 million pounds (+12%). The Middle East recorded 17.1 million pounds (+68%), and China/Hong Kong was down to 1.2 million pounds (-28%).

Commitments totaled 526.7 million pounds, down 13.2% from last year. New sales reached 184.2 million pounds, up 15% year-on-year.

On the supply side, ABC revised the 2024/25 ending inventory to 483.8 million pounds from the previously reported 514.9 million pounds, a reduction of 31.1 million pounds. The change reflects the actual loss and exempt adjustment rate of 3.14%, compared with the earlier forecast of 2.0%. An additional handler survey estimated that only 92.4% of the carryover is edible. Together, the adjustment and survey data suggest a tighter marketable carryover than previously assumed.

Crop receipts were reported at 259 million pounds, 10.7% below the same point last year. While early receipts are not considered a reliable indicator of total crop size, the figures align with recent anecdotal harvest reports.

Source: Mintec/Expana